All Categories

Featured

Table of Contents

- – Sought-After Accredited Investor Investment Ne...

- – Best Accredited Investor Alternative Investmen...

- – Premium Exclusive Deals For Accredited Invest...

- – Popular Real Estate Investments For Accredite...

- – Streamlined Accredited Investor Passive Inco...

- – Five-Star Exclusive Deals For Accredited Inv...

- – Specialist Passive Income For Accredited Inv...

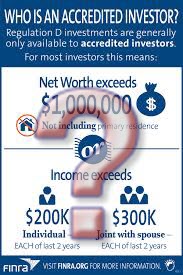

The laws for recognized investors differ amongst jurisdictions. In the U.S, the interpretation of an approved financier is presented by the SEC in Guideline 501 of Guideline D. To be an accredited capitalist, an individual should have a yearly revenue exceeding $200,000 ($300,000 for joint income) for the last 2 years with the expectation of gaining the exact same or a greater income in the present year.

This quantity can not consist of a key home., executive officers, or supervisors of a business that is providing unregistered securities.

Sought-After Accredited Investor Investment Networks

If an entity is composed of equity proprietors that are approved financiers, the entity itself is a certified financier. An organization can not be formed with the single purpose of acquiring details safeties. A person can certify as a recognized capitalist by demonstrating enough education and learning or work experience in the monetary sector

People who intend to be certified capitalists don't apply to the SEC for the designation. Instead, it is the duty of the company offering a personal placement to ensure that every one of those come close to are approved investors. Individuals or celebrations that intend to be recognized financiers can approach the company of the non listed securities.

Intend there is a specific whose revenue was $150,000 for the last three years. They reported a key home worth of $1 million (with a home mortgage of $200,000), a car worth $100,000 (with an exceptional lending of $50,000), a 401(k) account with $500,000, and an interest-bearing account with $450,000.

This person's net well worth is precisely $1 million. Considering that they satisfy the web worth need, they certify to be a certified capitalist.

Best Accredited Investor Alternative Investment Deals

There are a few less common credentials, such as managing a trust fund with greater than $5 million in assets. Under government safeties legislations, only those who are certified investors may take part in certain protections offerings. These may include shares in exclusive positionings, structured items, and exclusive equity or bush funds, amongst others.

The regulatory authorities intend to be particular that participants in these extremely high-risk and complicated financial investments can take care of themselves and judge the risks in the absence of federal government security. The recognized capitalist regulations are created to shield potential financiers with limited economic understanding from risky endeavors and losses they might be unwell furnished to stand up to.

Accredited investors meet credentials and expert requirements to accessibility unique financial investment opportunities. Approved investors need to satisfy income and web well worth requirements, unlike non-accredited individuals, and can invest without limitations.

Premium Exclusive Deals For Accredited Investors for Wealth-Building Solutions

Some essential changes made in 2020 by the SEC include:. Consisting of the Collection 7 Series 65, and Collection 82 licenses or various other qualifications that reveal monetary know-how. This adjustment identifies that these entity kinds are typically made use of for making financial investments. This change acknowledges the knowledge that these employees establish.

These modifications broaden the recognized financier swimming pool by around 64 million Americans. This wider accessibility gives more opportunities for capitalists, but additionally increases potential risks as less economically innovative, investors can take part.

One major advantage is the opportunity to purchase placements and hedge funds. These financial investment options are unique to accredited capitalists and institutions that qualify as a certified, per SEC guidelines. Exclusive positionings make it possible for business to protect funds without navigating the IPO treatment and governing documents required for offerings. This gives accredited capitalists the possibility to purchase emerging firms at a phase before they take into consideration going public.

Popular Real Estate Investments For Accredited Investors

They are checked out as financial investments and come just, to certified clients. In addition to well-known firms, certified investors can pick to buy start-ups and promising ventures. This supplies them tax obligation returns and the opportunity to go into at an earlier phase and possibly reap incentives if the company prospers.

Nevertheless, for capitalists available to the dangers included, backing start-ups can lead to gains. Most of today's technology firms such as Facebook, Uber and Airbnb came from as early-stage startups sustained by recognized angel capitalists. Advanced investors have the opportunity to check out investment alternatives that may generate much more earnings than what public markets provide

Streamlined Accredited Investor Passive Income Programs

Although returns are not ensured, diversity and profile improvement options are increased for capitalists. By diversifying their portfolios with these broadened financial investment opportunities certified capitalists can improve their strategies and possibly achieve exceptional long-term returns with proper threat administration. Experienced financiers usually run into financial investment choices that may not be conveniently readily available to the basic capitalist.

Investment alternatives and safety and securities used to recognized financiers typically include higher dangers. Private equity, venture capital and hedge funds frequently focus on spending in properties that lug threat however can be sold off easily for the opportunity of higher returns on those high-risk financial investments. Looking into prior to investing is critical these in circumstances.

Lock up durations protect against investors from withdrawing funds for more months and years on end. Financiers may struggle to accurately value private properties.

Five-Star Exclusive Deals For Accredited Investors

This modification might expand recognized financier status to a variety of people. Upgrading the income and property criteria for rising cost of living to ensure they reflect modifications as time progresses. The existing limits have actually remained static given that 1982. Permitting companions in dedicated partnerships to incorporate their sources for shared qualification as certified investors.

Allowing people with certain professional certifications, such as Collection 7 or CFA, to qualify as accredited capitalists. This would certainly acknowledge monetary elegance. Developing additional needs such as proof of financial literacy or effectively finishing a certified capitalist examination. This could ensure investors understand the dangers. Restricting or removing the key home from the total assets estimation to reduce possibly inflated analyses of wealth.

On the various other hand, it can likewise result in knowledgeable financiers assuming excessive threats that might not be ideal for them. So, safeguards may be needed. Existing accredited capitalists might face enhanced competition for the best financial investment chances if the pool expands. Business increasing funds may gain from a broadened recognized investor base to draw from.

Specialist Passive Income For Accredited Investors

Those who are presently taken into consideration certified investors should remain upgraded on any type of changes to the standards and laws. Services seeking certified investors ought to stay vigilant about these updates to guarantee they are attracting the best target market of investors.

Table of Contents

- – Sought-After Accredited Investor Investment Ne...

- – Best Accredited Investor Alternative Investmen...

- – Premium Exclusive Deals For Accredited Invest...

- – Popular Real Estate Investments For Accredite...

- – Streamlined Accredited Investor Passive Inco...

- – Five-Star Exclusive Deals For Accredited Inv...

- – Specialist Passive Income For Accredited Inv...

Latest Posts

Property Tax Deed

Government Tax Sales Homes

Tax Lien Property

More

Latest Posts

Property Tax Deed

Government Tax Sales Homes

Tax Lien Property